15 Jan 2014 AMC- Nasdaq and S&P500 new high for 2014 on Bank of America's earnings

Market Summary

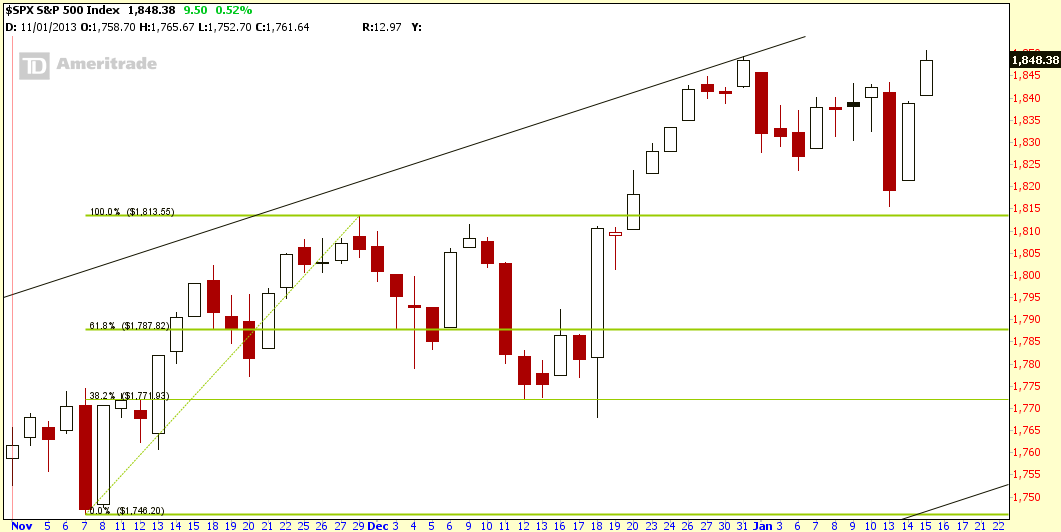

Equities built on their Tuesday gains, turning in their best two-day stretch since mid-December. During that two-day swing, the S&P 500 jumped from its lowest level of the year to a fresh record close of 1848.38. Stocks spent the entire session in positive territory after receiving an opening boost from the World Bank hiking its 2014 global GDP growth forecast to 3.2% from 3.0%.

Seven of ten sectors finished in the green with cyclical groups driving the advance. Financials (+1.2%) and technology (+1.2%) displayed early strength and their outperformance lasted into the close.

The financial sector was buoyed by its top components after Bank of America (BAC 17.15, +0.38) beat on earnings and revenue. The stock jumped 2.4% while JPMorgan Chase (JPM 59.49, +1.75) and Wells Fargo (WFC 46.40, +0.81), both of which turned in satisfactory reports on Tuesday, gained 3.0% and 1.8%, respectively.

Elsewhere, the tech sector was underpinned by some of its most influential members. Apple (AAPL 557.36, +10.97) did some heavy lifting, climbing 2.0% amid upbeat commentary surrounding its upcoming iPhone launch in China. Chipmakers also displayed strength after Intel (INTC 26.67, +0.16) received an upgrade for the second day in a row. The stock gained 0.6% while the PHLX Semiconductor Index rose 0.9%.

Outside of the two largest sectors, gains in other areas were much more subdued. Industrials (+0.7%) and materials (+0.7%) outperformed while the remaining cyclical groups—consumer discretionary (+0.2%) and energy (-0.3%)—lagged.

Notably, the discretionary sector was pressured by homebuilders and retailers. The iShares Dow Jones US Home Construction ETF (ITB 24.31, -0.05) and SPDR S&P Retail ETF (XRT 84.02, -0.29) both slipped 0.3% with the retail ETF extending its 2014 loss to 4.6%.

On the countercyclical side, telecom services (+1.5%) outperformed while consumer staples (unch), health care (-0.1%), and utilities (-0.2%) lagged.

Treasuries posted modest losses as the 10-yr yield ticked up one basis point to 2.88%.

Participation was a bit below average as 704 million shares changed hands at the NYSE.

Also of note, the Federal Reserve released its January Beige Book, but true to form, the report was essentially ignored by the market. The report indicated that during the six weeks of 2013, the twelve Fed Districts observed a continued expansion of economic activity. Nine districts characterized the expansion as ‘moderate' while Boston and Philadelphia Districts described the pace as ‘modest.' For its part, the Kansas City region saw little change in activity.

With regard to manufacturing, nearly all districts reported steady growth in the sector but Kansas City saw a decline in production and shipments.

Lastly, prices were largely unchanged across all regions. However, Kansas City was singled out again in this section for observing a rise in some raw material prices.

Today's economic news included three data points:

- December PPI increased 0.4% while the Briefing.com consensus expected an uptick of 0.3%. Energy prices were a main contributor, increasing 1.6%. Most of the gain in energy costs was a result of a 2.2% increase in gasoline prices. Food prices fell 0.6% due to a 13.4% decrease in vegetable prices. Excluding food and energy, core prices unexpectedly spiked in December. Prices increased 0.3%, the largest monthly jump since rising 0.5% in July 2012. The consensus forecast called for a more modest uptick of 0.1%.

- The Empire Manufacturing Survey for January jumped to 12.5 from 1.0 while the Briefing.com consensus expected the survey to improve to 3.5.

- The weekly MBA Mortgage Application Index jumped 11.9% to follow last week's 4.2% decline.

Tomorrow, weekly initial claims and December CPI will be released at 8:30 ET while Net long-term TIC flows for November will be announced at 9:00 ET. The January Philadelphia Fed survey and the January NAHB Housing Market Index will both be released at 10:00 ET.

- Nasdaq +0.9% YTD

- Russell 2000 +0.7% YTD

- S&P 500 0.0% YTD

- DJIA -0.6% YTD

Market Internals

Leaders & Laggards

Technical Updates

Next Day in View

No comments:

Post a Comment