Market Summary

The stock market endured a forgettable start to the new trading week as the major averages ended on their lows. The S&P 500 fell 1.3%, ending at its lowest level of 2014.

Equities began the session with modest losses and spent the first three hours of action near their flat lines. The indices were able to inch back into positive territory during the late morning, but the move lacked conviction and failed to invite dip-buyers to the party. Shortly thereafter, sellers were the ones partying as the indices spent the entire afternoon in a steady downdraft.

In all likelihood, the selling was exacerbated by the fact many participants were not positioned to absorb today's volatility. On that note, the CBOE Volatility Index (VIX 13.37, +1.23) began the session in the red and tested multi-month lows before afternoon weakness sparked a rush for downside protection.

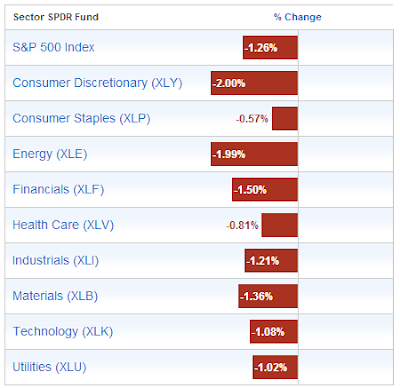

All ten sectors ended in the red but cyclical groups saw the largest losses. The consumer discretionary sector (-2.0%) finished behind the remaining groups as retailers lagged after Bon-Ton Stores (BONT 13.41, -2.09), Express (EXPR 18.15, -0.87), Lululemon (LULU 49.70, -9.90), and PVH (PVH 129.55, -2.58) issued disappointing guidance. The four names lost between 2.0% and 16.6% while the SPDR S&P Retail ETF (XRT 83.36, -2.48) fell 2.9%, widening its January loss to 5.4%. For its part, the discretionary sector extended its January decline to 2.6% after ending 2013 ahead of the remaining nine sectors with a gain of 40.4%.

Elsewhere, the energy space (-1.9%) also played a significant part in pressuring the broader market. The sector lagged throughout the session as crude oil fell 0.9% to $91.78 per barrel. The other commodity-related sector—materials (-1.4%)—fared a bit better but also finished behind the S&P 500 even as gold futures added 0.4% to $1251.10 per troy ounce.

On the countercyclical side, consumer staples (-0.6%), health care (-0.8%), telecom services (-1.1%), and utilities (-0.9%) finished ahead of the broader market.

In M&A news, Beam (BEAM 83.42, +16.45) surged 24.6% after the company agreed to be acquired by Suntory Holdings for $83.50 per share.

Despite the selloff, participation was below average as 719 million shares changed hands on the floor of the New York Stock Exchange.

Treasuries ended on their highs with the 10-yr yield down three basis points at 2.83%.

Economic data was limited to the December Treasury budget, which showed a surplus of $53.20 billion after showing a deficit of $1.20 billion in December 2012.

Tomorrow, December Retail Sales as well as December export prices ex-agriculture and import prices ex-oil will be reported at 8:30 ET while the November Business Inventories report will cross the wires at 10:00 ET.

- Russell 2000 -1.2% YTD

- Nasdaq -1.5% YTD

- S&P 500 -1.6% YTD

- DJIA -1.9% YTD

Market Internals

Leaders & Laggards

Technical Updates

Alvin's commentaries

The major indices started rather flat near the opening line however at 12.30 EST, Fed's Lockhart announced that he support more tappering which quickly sees the bear dominating the session all the way to the closing bell.

No comments:

Post a Comment